spdr sp 500 etf: Latest News & Videos, Photos about spdr sp 500 etf Page 1

Contents

In times of rising prices, you may want to consider these sectors and stocks. ‘Don’t put all your eggs in one basket’, is a common phrase used in the investment world. It means that putting all the eggs in one basket increases the risk as if the basket falls; all the eggs will break. However, Comparing Financial Planner vs. Financial Advisor if the eggs are put in multiple baskets, the risk of all of the eggs breaking reduces significantly. The same principle is religiously followed by professional investors in the stock market who divide and invest their capital across various asset classes and investment instruments.

IShare UK Property ETFPrimary ExchangeLondon Stock ExchangeTickerIUKP10 Year Return6.26%Fund managerBlackRock Asset ManagementTracksFTSE EPRA/NAREIT UK IndexDenominationGBPExpense Ratio0.40%Fund Size (m £)485No. Of holdings47The iShare UK Property ETF was launched in 2007 and tracks the FTSE EPRA NAREIT UK Index which aims to follow trends in real estate equities. When people think about investing in UK, they usually think about property investing due to its appealing and accessible buy-to-let market. ISK and VUKE are both distributing ETFs which means they’ll distribute the dividends collected from the underlying holdings to their shareholders on a fixed schedule.

Where do millionaires keep their money?

Many millionaires keep a lot of their money in cash or highly liquid cash equivalents. They establish an emergency account before ever starting to invest. Millionaires bank differently than the rest of us. Any bank accounts they have are handled by a private banker who probably also manages their wealth.

Since the value of a single stock is a 10th, SPDR trades at around a 10th of the dollar value level of its mirroring index, i.e. IBB is the largest biotech ETF in terms of assets, with approximately $10 billion under management. It is one of the most well-known methods to gain exposure to the high-growth sector of health care.

QQQ – Invesco QQQ Trust Series 1 (The NASDAQ

But, for a long-term investor, it is futile to time the market and wait for the market correction to be over. Therefore, it is better for retail investors to systemically buy ETF units on a fixed date and bump up the holdings with additional units on days when the market dips. This exercise may help investors to accumulate more units and as equities tend to drift upwards over the long term, they may stand to benefit.

How long will the 2022 bear market last?

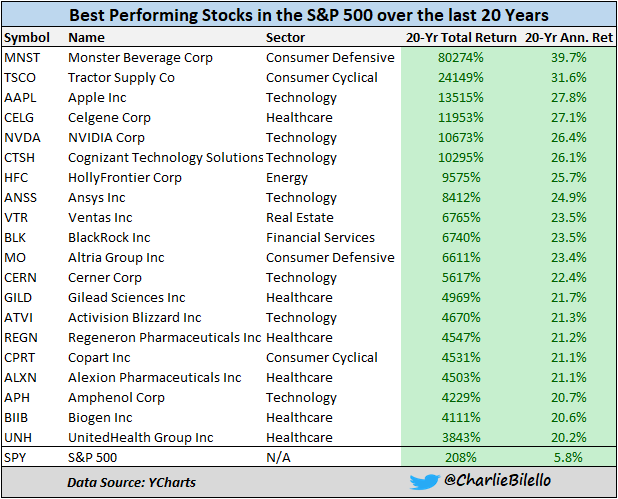

The bear market in the S&P 500 was confirmed on June 13th 2022, but the market began its slide on January 3rd 2022. With this date as the start of the current official bear market, the average bear market of 289 days means that it would finish on 19th October 2022.

The SPDR fund is now the second-largest biotech fund, with around $6 billion in assets. Although it has a similar concentration on gene-editing businesses, growth-stage drugmakers, and excellent diagnostic companies as IBB, it is built differently. It offers a limited list of equities, with just roughly 200 components in the portfolio. They also offer investors the ability to trade them easily on a stock exchange, which means that investors can buy and sell them throughout the day like they would with any other stock.

Exchange Traded Funds

Vanguard S&P 500 growth ETF is the best choice if you like to invest with the best. This ETF tracks the S&P index and allocates a large sum from its Asset Under Management to FAANG stocks. Trade Brains is a Stock market analytics and education service platform in India with a mission to simplify stock market investing. The cost of heating and cooling homes and offices remains high when inflation is high, which means people will give up their expensive vacations or dinner out during times of high inflation.

Should I move my investments to cash 2022?

There are a lot of better choices than holding cash in 2022. Inflation will deteriorate the value of your savings if you decide to stash your cash in a bank account. Over the long run, you'll be better off investing now, even if expected returns are lower than they've been historically.

Within ETFs, Spider ETFs are frequently utilised for earning hefty profits. Exchange-traded funds or ETFs are a type of investment fund that holds a basket of assets, such as stocks or bonds, and can be traded on an exchange like a stock. ETFs offer many benefits, including low costs, diversification, and liquidity. For instance, if you wish to buy shares in businesses that are situated in South America or Asia, you will find that it is either very difficult to do so or that it will be quite expensive.

ICICI Prudential Gold ETF

Also, dividend aristocrats are generally large blue-chip stocks which tend to be less volatile than small-cap stocks. In these challenging times of lockdown and quarantine, everything around us is at a literal standstill, including our stock market. It’s not a surprise that the Indian markets are currently witnessing massive volatility due to the Covid-19 pandemic. Many of us now wish they had diversified their portfolio, or are looking for efficient ways to diversify it now.

Assets under Management – AUM is defined as the market value of all the financial assets that a company manages for its investors. If a company has a high AUM value, it reflects on the high number of clients and portfolios that it handles. The best way to invest in FAANG stocks on your own is to open a DEMAT account in the US. Doing this will open doors for all the companies you want to invest in in the US. Although retail investors in the United States and the United Kingdom have relatively simple access to large-cap companies listed in those countries’ markets, this is not always the case in other marketplaces. REITs that hold might diversify both retail and office properties or specialty REITs.

For instance, eToro enables users to copy the trades of successful ETF investors using a feature called Copy Trading. You will have the opportunity to gain money via two distinct income streams unless you invest in a commodity exchange-traded fund . To start, you will have the right to proportion part of any dividend payments that are made to the ETF. In 2021, the dividend yield will be 2.90%, and the company will double its dividend.

But investing in properties directly requires a higher capital as well as the time and effort to manage the actual properties. Also, as a independent property investor, you may not be able to own property across all the sectors especially when you’re new to the game. The FTSE 100 is an index of the 100 largest companies listed on the London Stock Exchange.

Where there is an ETF, there’s an Index

One of the main advantages of ETFs is that they offer a low-cost, and tax-efficient way to invest in a diversified range of assets. Some trusted ETF brokers include Interactive Brokers, Hargreaves Lansdown, AJ Bell Youinvest, Charles Schwab, etoro, and more. Dividend Aristocrats refer to stocks that have increased their dividend for at least 25 consecutive years.

The investment seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the S&P 500® Index. Rukesh Reddy, Director of Digital Transformation at Citibank in New York, talks about why every investor needs to lean heavy on software companies while building an investment portfolio. Still, SPY has suffered net outflows of $2.84 billion in the past year. The fund has been buffeted along with stocks in pandemic-fueled volatility, while its relatively high expense-ratio has seen it lose ground to cheaper competitors.

Shareholders of REITs typically receive dividends from the company’s rental properties and lease space to tenants. It is not the ownership of real estate that makes mortgage REITs unique, but rather the real estate financing. The interest they earn on the investments they make provides them with income. Despite low overall volatility in the market, commodity futures trading can still be very lucrative.

To start investing in US stocks, the exchange traded funds listed on the US stock exchanges can be a good starting point. Unlike buying individual stocks, you end up buying a bunch of stocks representing either an index or a specific sector. US ETFs give you the advantage of diversifying in international stocks and also keep you diversified across various leading themes in the US stock market. From technology growth to value-stocks to large-caps to small caps, the US ETFs are available to keep your portfolio well-diversified. For example, NIFTY 50 is a basket of the top 50 companies on the National Stock Exchange, chosen from different sectors of the economy.

Top 7 Biotech ETFs in 2022

As a gold and copper producer with operations in 18 countries in North America, Africa, South America, Saudi Arabia, and Papua New Guinea, Barrick Gold Corporation is one of the world’s largest companies. The stock currently yields 2.5%, and analysts recommend it as a strong buy with a rating of 1.9 out of 5. Reduced 30% in a year, international freight prices are good news for exporters. Short interest in the SPDR S&P 500 ETF Trust increased to its highest level this year since last week’s Fed meeting, suggesting investors have been adding more downside protection, JP Morgan analysts said in a recent note. Global markets typically rebound from war and disaster, and they are likely to do so this time, too.

- For the longest time in the US, actively managed mutual funds ruled the roost.

- Also, as a independent property investor, you may not be able to own property across all the sectors especially when you’re new to the game.

- The investor then could lock in yields for longer by shifting into two-, three- or five-year Treasury notes, where yields also are attractive.

- The SPDR S&P Retail ETF, which tracks a broad group of retailers such as department and specialty stores, is up nearly 40 per cent this year.

- Assets under Management – AUM is defined as the market value of all the financial assets that a company manages for its investors.

Among intermediate funds highly rated by Morningstar is Pimco Total Return , which yields more than 3%, charges 0.80% in expenses and is down about 17% this year. An exchange-traded fund option to consider is Vanguard Intermediate-term Bond . Released by the Federal Reserve meant more optimism among market participants.

The investment seeks to track the investment results of the PHLX Semiconductor Sector Index composed of U.S. equities in the semiconductor sector. Our services are non-advised however, we may facilitate providing you with required advice through eligible third-party providers. Customers may choose to avail the services of certain third-party service providers of Winvesta and will be bound by the terms, conditions, and privacy policies of such Partners while using their services.

If we receive complaints about individuals who take over a thread or forum, we reserve the right to ban them from the site, without recourse. This certificate demonstrates that IIFL as an organization has defined and put in place best-practice information security processes. The SPDR ETFs are listed in the US on the New York Stock Exchange and in India on the National Stock Exchange under the ticker symbol of SPY. Previously, they used to trade on the American Stock Exchange but shifted to the New York Stock Exchange in the US after the former was acquired by the latter. FibroGen Inc. , which is a $1 billion biotech focused on several rare organ ailments, is now among the top holdings.

There are stocks in different sectors that perform just like this, and FAANG stocks are the ones from the technology sector. Despite this, some stock types do better than others during inflationary periods. Inflation hedges are stocks of companies that manufacture products consumers will buy regardless of price increases. The dividends are paid by the stocks that perform well as prices rise to generate a little extra cash when costs rise.

One possible explanation for this is that the ETF is invested in a diversified portfolio of dividend-paying equities and bonds. Second, the value of your investment will go up in tandem with any and all gains in the worth of the assets that https://1investing.in/ are held in the ETF. An ETF can own tens or hundreds of stocks across a range of industries, or it could be restricted to a single sector or industry. There are funds whose focus is solely on U.S. offerings and others whose focus is global.

Many floating-rate funds own bank loans made to companies with lower credit standing to enjoy higher rates. The funds’ yields edge upward as rates rise and now stand around 4% or more. But managers of some of these funds take more credit risk than others, says Morningstar’s Mr. Mulach, so fears of recession could hurt performance. Bond prices move inversely to yields, so as the Federal Reserve has lifted rates to slow growth and damp inflation, most bonds have lost principal value—at least on paper. But, barring a default, someone who keeps an individual bond to maturity will get back all of the initial outlay as well as interest. The caveat is that choosing individual bonds poses some complexity, so it might be helpful to work with an adviser or broker when buying them.

Leave your comment