The Psychology of Forex Trading, How To Get Your Mind Right

Contents

I have been a trader long enough to know a thing or two about how most people think while trading the market. There’s a common saying among financial traders that “when bulls and bears make profits, pigs are slaughtered”. The pig is a very greedy animal, and the analogy is useful in the trading business, since it shows that the market does not respect pigs—greedy pigs lose their money. ForexSignals.com US Economic Outlook: For 2020 and Beyond takes no responsibility for loss incurred as a result of the content provided inside our Trading Room. By signing up as a member you acknowledge that we are not providing financial advice and that you are making the decision on the trades you place in the markets. We have no knowledge of the level of money you are trading with or the level of risk you are taking with each trade.

Just like in the gambling world, one major win on the markets could lead a beginner trader to think that they will win every time, but this is simply not the case. The forex markets are unpredictable, and can often move in directions that even the greatest trading minds cannot always predict. The following article will cover the typical psychological traps that beginner traders can fall victim to when they are just starting out. This article will also provide traders with useful forex psychology tips that they can use to avoid these traps and stay on top of their game at all times. Whilst every trader needs a great trading strategy that will make them winning trades, if you are making the same mistakes over and over again, then you will continue to lose money.

What You MUST Know About Psychology In the Financial Markets

The fear of failure causes a psychological scare in our minds and send us dreadful warnings before making trade decisions. ForexSignals.com helps traders of all levels learn how to trade the financial markets. Self-reflection is mandatory to help traders understand their attitudes towards trading, learn from their mistakes, and stay ahead of other traders. A consistent strategy is one of the most important factors to forex trading success. Emotional trading will not lead you to forex trading success. Irrespective of whether you are an amateur or an expert trader, everyone can take value from us.

Our signals are completely FREE and offers you with 70% monthly accuracy. Each and every Forex trader needs to not only create a trading plan and select his or her strategies but also need to prepare… Forex trading is often referred to as an emotional rollercoaster ride due to the ups and downs of various emotions that humans can experience… There are psychological mistakes that you can make at any time during your trading career, and many people do, even those that have been…

That’s right – at the beginning of your trading career it’s very easy to fail! This is because many people believe that trading is easy money. Once you have got three consecutive profit trades or losing trades, it is better to take a break. If you get three consecutive profit trades, your fourth trade may be entirely motivated by overconfidence. If you get three consecutive losses, your fourth trade will be driven by an extreme need to earn back the money you have lost.

Reasons You’re Not Meeting Your Trading Goals

If you have learned the art of managing your emotions, you can certainly call yourself as an experienced and professional trader. Many traders enter into a tailspin of emotional trading and losing money after they hit a string of winners. Fear – Traders become fearful of entering the market usually when they are new to trading and have not yet mastered an effective trading strategy like price action trading . Fear can also arise in a trader after they hit a series of losing trades or after suffering a loss larger than what they are emotionally capable of absorbing.

- ForexSignals.com helps traders of all levels learn how to trade the financial markets.

- Simply stick to your strategy and risk management plan to avoid this pitfall in forex.

- Whilst a lot of them are good reads, a lot of them are also incredibly boring.

- Greedy traders also add to open positions whenever the market has moved according to their expectations.

- There are many trading psychology books you can read to improve your trading.

Now, let’s be honest, the weakest part in any trading strategy is always the trader themselves. While some of these emotions may be useful and should be embraced, others such as greed or anger should be contained. Trading psychologists believe that even though psychological stimuli are different for each trader, there are still a number of universal influences.

Forex Psychology is a field of expertise that is essential to be acknowledged by any trader willing to achieve continuous positive results from their operations in the financial markets. It is important to understand that trading theory is indispensable, yet to apply it in practice one needs to be well-prepared also in terms of clear mind and cool spirit. It is commonly known that such psychological factors as fear, as well as euphoria, might destroy any achievement in a short time span. Forex psychology brings to the limelight such essential aspects of human action as personal and collective behavior or market sentiment.

Typically, a trading plan consists of a set of guidelines and strategies for executing trade decisions. Euphoria often leads to a slippery slope of trading errors and losses. After a series of successful trades, a trader can become overconfident and start placing trades without careful analysis of the ever-changing market conditions. Revenge trading is harmful because of three main reasons.

We use the information you provide to contact you about your membership with us and to provide you with relevant content. I’ve been a trader for many years and this has also helped me because of the 24hr liv… Best Mentors with good understanding how the market works! Mastering the Forex psychology takes a lot of reflection and self awareness. The market can mess with your mind but there are ways to stay in charge.

If You Don’t Learn About the Pygmalion Effect Now, You’ll Hate…

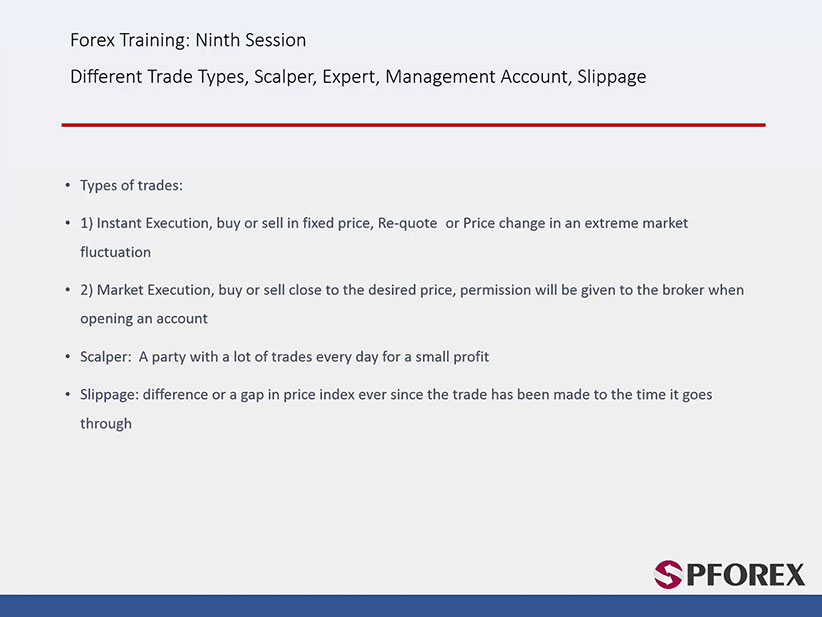

It is said that the personal psychological challenge constitutes 90% of the struggle to achieve consistent success as a forex trader. The vast majority of traders, not only beginners but also more experienced ones, do not know the difference between these order execution systems. The effect of leverage allows you to trade larger amounts of money than you invest. However, leverage can either operate for your side or against you. Some traders choose a big size of leverage to work with more significant sums. It creates the illusion of “unlimited opportunities without any risk”, but it is not always like that.

Effectively I lost a decade of my life winning a struggle which so many give up on. Have you ever tried to pick up a piece of quicksilver, i.e. mercury? It’s so easy – right up until the very last moment when it tantalisingly slips away from you. Well that’s what currency trading is like for so many people. They lose their money, they lose their confidence Worse, they lose their dreams and their chance of a better life.

Trading Psychology: How to Master Your Trading Mind With Free PDF

In other words, an impulsive decision and a small loss could wipe out all the profits you have made by trading forex. When you don’t know how to handle emotions, it can ruin your trading day and cause damage to your trading account to the extent of losing a huge amount of money. The reason is simple; We take hasty and irrational decisions https://1investing.in/ when we are angry, depressed or greedy. Now that you are trading with a real trading account, you might experience difficulty in terms of managing your emotions while trading. For example, if you make a major loss, it might be tempting to quickly try to recover your losses with another trade, which would likely lead to further losses.

Determine significant support and resistance levels with the help of pivot points. Learn about crypto in a fun and easy-to-understand format. From basic trading terms to trading jargon, you can find the explanation for a long list of trading terms here.

Things to Consider When Picking Forex Market Tops or Bottoms

Some traders fall victim to making one or several… This often occurs when a trader gets a big successful streak. Though you may feel invincible, this will not be the case. Here we should note that you should never enter the market with money you can’t afford to lose. The forex market is a fluctuating market where both amateurs and professionals can lose.

Leave your comment